Marble Pier

The Marble Pier is a jointly-delivered project by Ramboll and Henning Larsen for AP Pension. The Marble Pier will be one of the largest timber buildings ever constructed in Denmark.

98% of all survey respondents consider sustainability important for successful business operations. This is an increase of 4% from the 2021 survey and it affirms, what we already know: Sustainability will permeate business operations now and in the future.

The Sustainable Buildings Market Study 2023 is now available. Every other year we ask investors, developers, contractors, engineers, architects, and designers from all over the world to give their take on the current state and prospects for the construction and real estate industry in relation to sustainability.

The study covers insights into:

This market study is the seventh of its kind, formerly known as the Green Market Study. The 2021 study can be found here.

The decarbonisation of the built environment is one of the most important challenges within the sector. The recently published IPCC AR6 Synthesis report has reiterated the urgency of the issue and highlighted the potential consequences of inaction. It also identifies a potential reduction of GHGs associated with buildings of 66% by 2050 through demand side reduction. The reduction in operational energy demand and associated carbon is considered a key measure that needs to be taken alongside the design of buildings and infrastructure with reduced upfront embodied carbon. Whilst we must make even greater efforts to reduce GHG emissions, we must also recognise the need to adapt to our changing climate. This has significant impacts on how we will design new buildings and refurbish existing buildings to cope with more extreme weather events.

The importance of this critical issue has also been recognised in the survey responses. An increased focus on carbon neutrality and climate change mitigation due to national implementation of Paris Climate Agreement was identified as the most important trend in the construction and real estate sector with 62% of respondents placing this in their top 5 trends, an increase of 6% from the previous study. Furthermore, 50% of respondents now have net zero carbon buildings as part of their business strategy, an increase of 19%. In addition, for those organisations who include net zero carbon buildings in their strategy 92% also have specific targets to reduce the carbon footprint of their buildings, this is an increase of 30% compared to the 2021 study.

These responses indicate the speed at which the industry is moving to embed the decarbonisation of buildings in their strategies and the need to have targets and metrics that can be used to assess performance in meeting strategic goals. This is consistent with the fact that adopting a Whole Life Cycle approach was also one of the most important trends identified, with 60% of respondents placing it in their top five trends. With whole life carbon and embodied carbon targets now starting to become part of national regulations, such as the new mandatory regulations in Denmark, and EU wide policy, such as the updated EPBD, it is clear that businesses within the sector must ensure they are aligned with the accelerating decarbonisation shift to stay competitive.

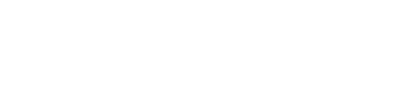

Image 1: Roll-out of Danish whole life carbon regulations

Image 1: Roll-out of Danish whole life carbon regulations

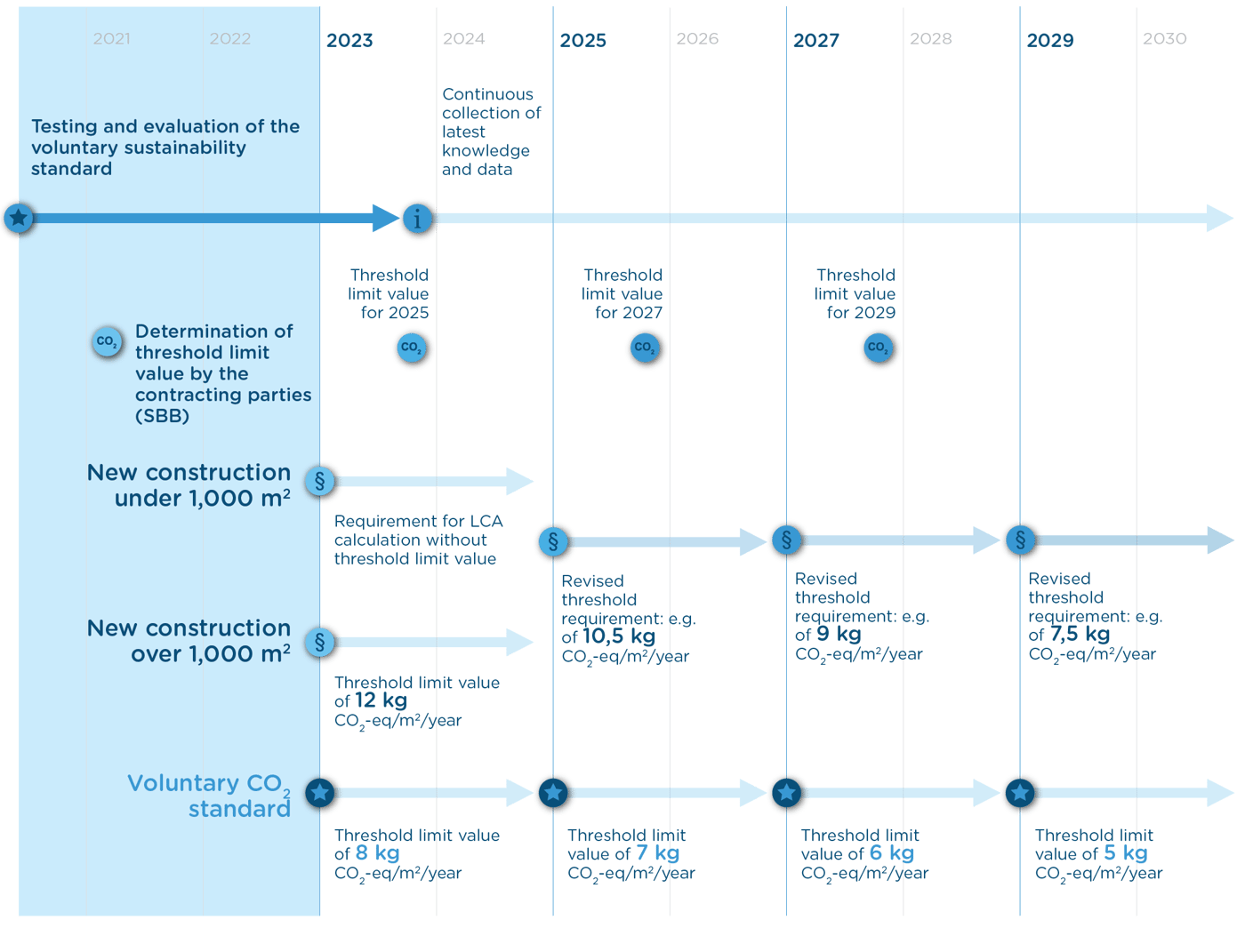

A Whole life cycle approach and the use of LCA measurement methodologies are key in order to deliver and measure decarbonisation within building portfolios. However, recent work by Ramboll’s LCA specialists has identified the range of different LCA methodologies being used internationally within the real estate sectLife Cycle Stages included in an LCA. The significant variation in what is measured presents a key challenge when seeking to measure performance against targets, especially with international portfolios.

Image 2: Life Cycle Stages included in an LCA

Image 2: Life Cycle Stages included in an LCA

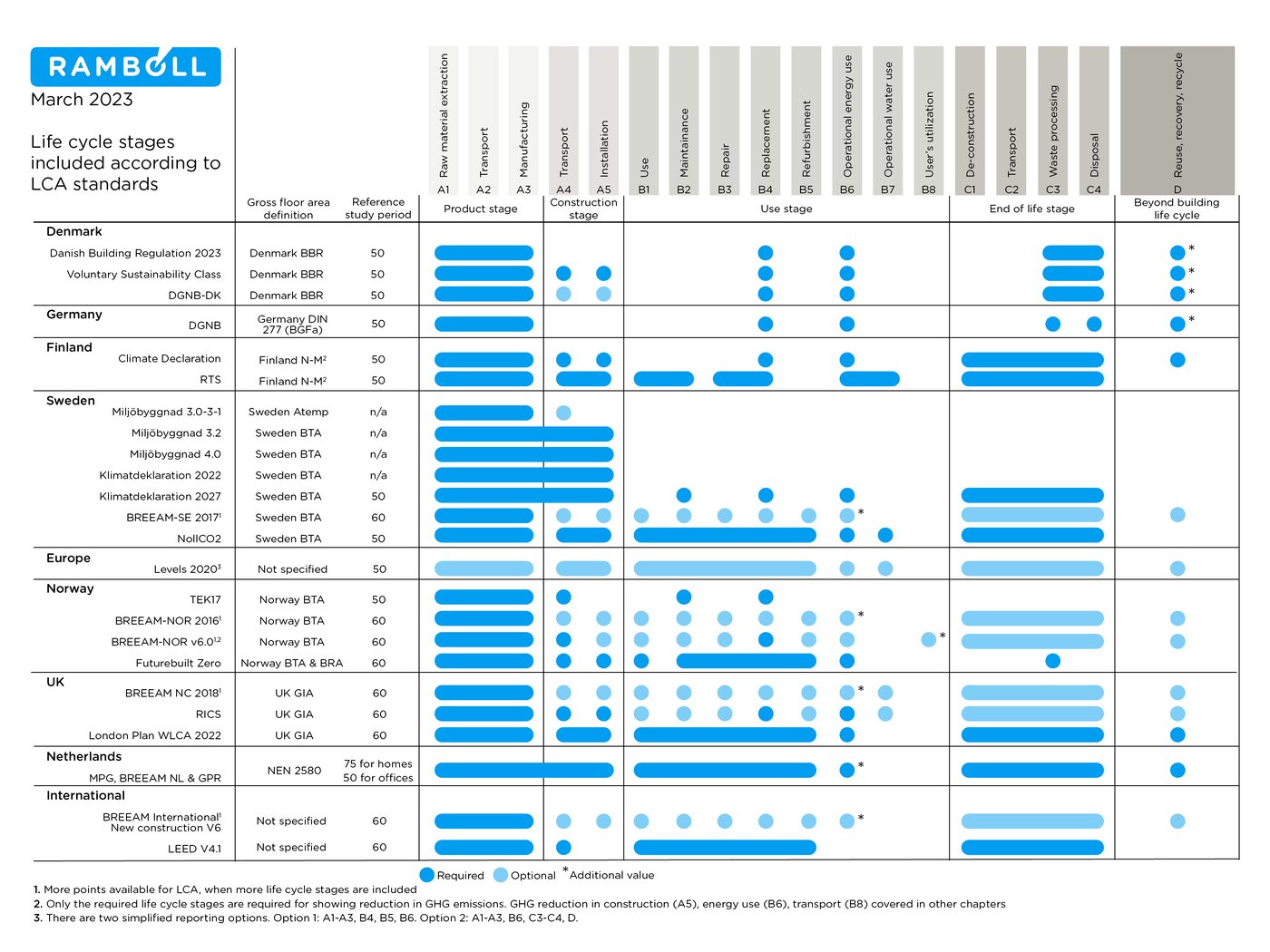

Image 3: Building elements included in an LCA

Image 3: Building elements included in an LCA

Ramboll is supporting our clients in the interpretation of these different methodologies as well as developing the tools to compare different types of assessments as part of the process to measure our own performance against our ambitious carbon targets. We are also advocating for industry wide harmonisation of carbon measuring methodologies and contributing to the current update of the RICS Professional Standard on Whole Life Carbon Assessment for the Built Environment, one of the key industry methodologies used in the UK and referenced internationally. The industry must be able to work together consistently to tackle decarbonisation. Harmonised and transparent carbon measurements will be key to unlocking the most effective carbon reduction strategies.

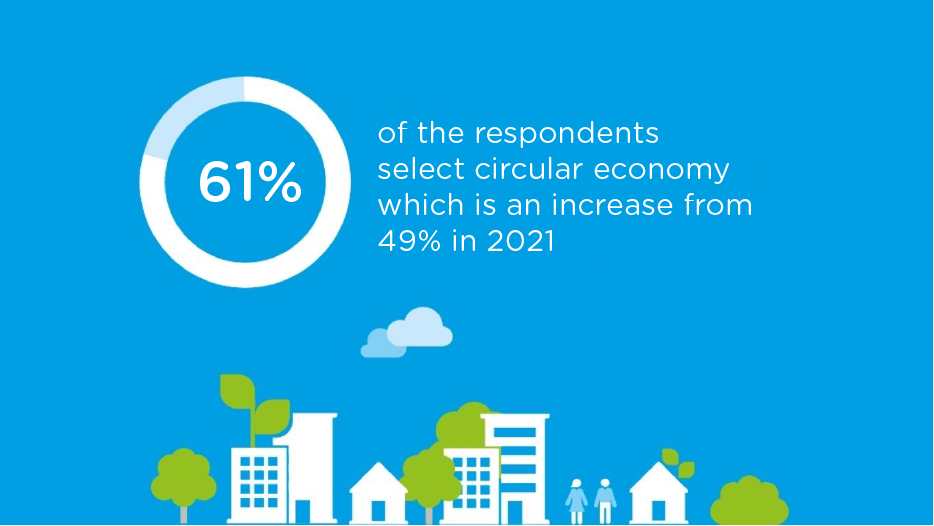

When responding to the question - Which of the following present trends do you consider most important for the construction and real estate sector? 61% of the respondents select circular economy which is an increase from 49% in 2021. A clear trend post-pandemic has been the increased focus on repurposing the existing building stock extending. 62% of respondents select carbon neutrality, which has been high on the agenda in all the previous studies. 60% respond Whole Life Cycle approach an option that was added in the 2023 survey.

In relation to the circular economy, it’s clear that transitioning to a circular approach related to our building stock is essential if we are to minimise the consumption of virgin materials and mitigate C02 emissions originating from the extraction and processing of materials used in the built environment.

Circular renovation methods such as extending the lifespan of existing buildings and increasing the intensity of building use are some of the most effective manners to reduce embedded carbon emissions as this minimises the demand for new construction, which consumes more materials than renovating existing buildings.

As well as the sustainability benefits there can be other more short-term financial benefits related to retaining existing buildings. This can help explain the increased focus amongst the respondents on reusing and refurbishing existing buildings rather than building new ones. First is time, from the initial inception of the idea to construct a new building to the building hitting the market years can go by. With an existing building, the refurbishment programme can be delivered much faster. Second, post-pandemic there has been a need to redesign existing buildings to accommodate new working patterns and it has been hard to gauge future demand for commercial, retail and office buildings making the construction of new buildings a less certain investment.

Read more here about the case for building next to nothing: https://worldgbc.org/article/the-case-for-building-next-to-nothing-ramboll/

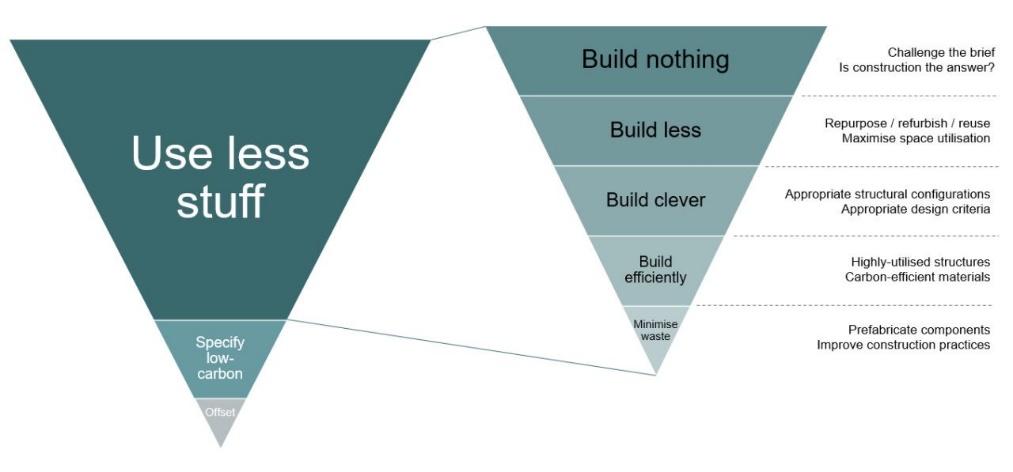

Image caption: The most sustainable building is the one already built. As consultants, we need to have the courage to challenge clients’ briefs and give them viable alternatives with lower carbon impacts (Source: Institution of Structural Engineers, IStructE)

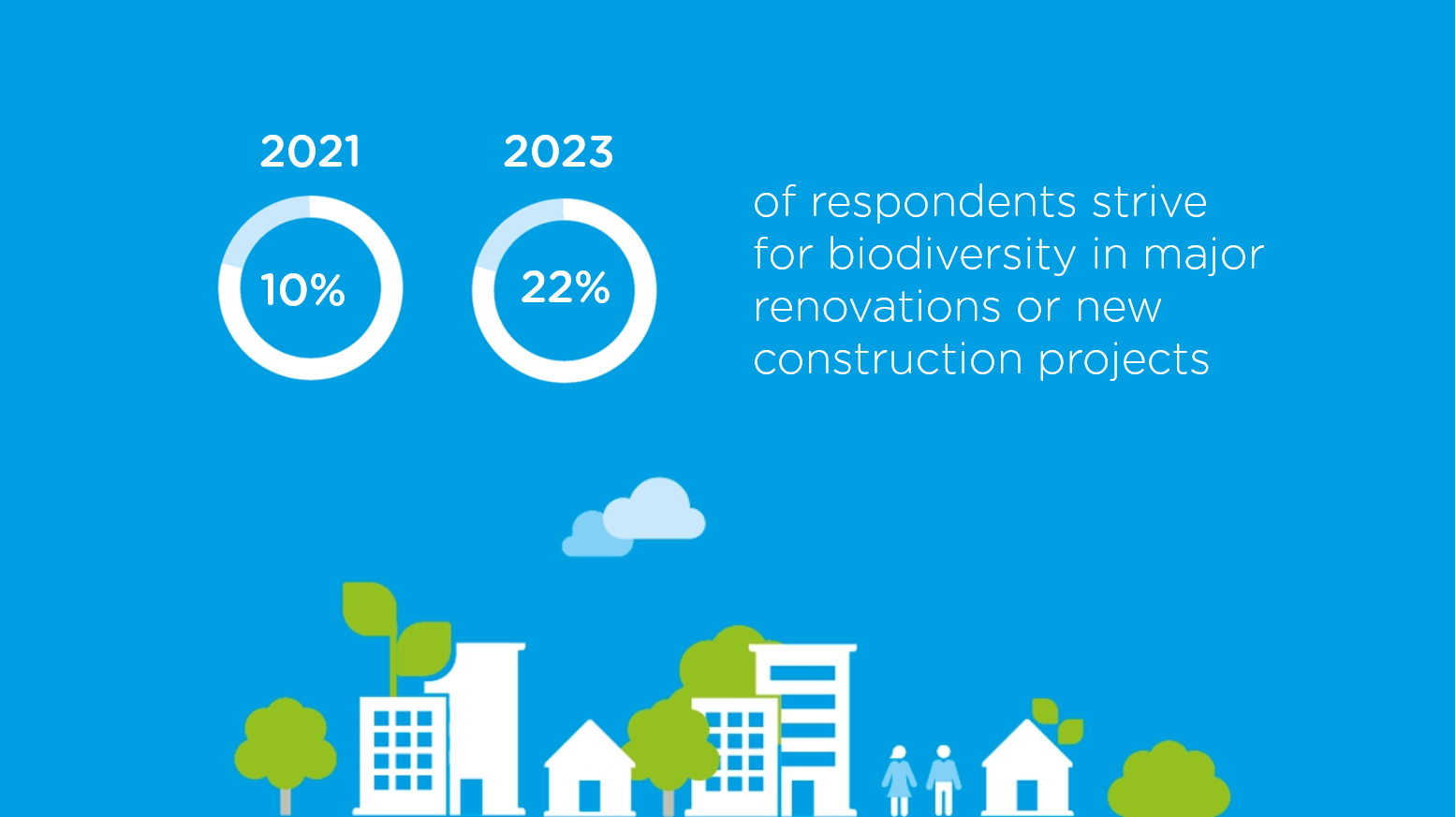

12% increase from 2021 to 2023.

There is a good reason behind the increase in biodiversity focus on renovation and construction projects: Loss of biodiversity is seen by the UN and others as the biggest threat to human existence, followed closely by the climate crisis. Humans have been putting pressure on nature by consuming its resources without supporting recovery and have already transformed over 70% of land surfaces and are using about three-quarters of freshwater resources. However, there are tremendous gains by embracing nature's transformation now. WEF Future of Nature and Business states that nature-positive transitions could generate up to US$10.1 trillion in annual business value and create 395 million jobs by 2030.

As examples of concrete actions to improve biodiversity in the built environment, the Municipality of Copenhagen is launching a new strategy that will entail biodiversity schemes in all renovation and construction projects going forward. In the UK in particular, new legislation is being implemented to protect and promote biodiversity in all types of construction and infrastructure projects – through e.g., the natural capital accounting standard (BSI), biodiversity net gain (BNG) and metric development, Science Based Targets for Nature, and the Taskforce on Nature-related Financial Disclosures (TNFD).

The positive effects that nature has on humans are well-documented – and people are asking for accessibility to nature. So, creating space for nature and biodiversity is also very much about well-being.

What can the building sector do in practice? Apart from indoor and outdoor planting schemes, beehive installations, etc, it is also important to have awareness and build biodiversity into strategies and action plans, and further push for the protection of nature and species in local, regional, and even national planning. Indirectly, biodiversity is also highly affected by water bodies and greenfield impacts, so considerations to water resource management, e.g., the use of grey water in the building, and the use of recycled building materials with a lower environmental impact are also important.

See examples of nature positive solutions in the built environment here

Read more on Biodiversity Net Gain – How greening developments can benefit us all

0% in 2021 to 30% in 2023.

30% are now reporting on the EU taxonomy according to our survey – and there is no doubt this number will be close to 100% in 1-2 years. The EU Taxonomy requires European financial and non-financial companies to demonstrate the environmental sustainability of their economic activities. The first disclosures already apply so it is time to act now.

But what will this mean for the construction sector? For one, it will mean access to finance and insurance will change and only be available if certain criteria are met. Criteria range from recycling, and energy and water efficiency to life cycle CO2 calculations, climate resilience, chemical compounds, and greenfield restrictions.

As the Taxonomy reporting requirements now fully start to impact developers, institutional investors and contractors at the corporate level, processes are being developed to allocate financial metrics such as CAPEX, OPEX and Revenue to Taxonomy-aligned activities for the annual reporting.

We do however observe a gap between the reporting at the corporate level and the implementation of Taxonomy criteria in new developments. While corporate-level reporting relies on aggregated data from the entire business, the implementation at the project level requires vastly different initiatives. At the project level, the Taxonomy criteria and compliance must be interpreted into concrete actions allocated to building owners, contractors, developers, advisers, and asset managers.

Asset owners must ask themselves how they go about implementing the Taxonomy and whether it be secured through normal procedures with Taxonomy as an “add-on” in development and control criteria, or whether new certifications can show the way. In any case, it is imperative that actors in the construction industry rely on advisors that set the bar high in terms of interpreting Taxonomy criteria, to ensure compliance with the Taxonomy criteria, even if an improved EU definition is still pending.

Read more on The EU Taxonomy in 2023 – More clarity or more confusion?

We invite you to participate in a webinar on the findings of the Sustainable Buildings Market Study 2023, where key experts from Ramboll will unfold and discuss the findings and place them into a context of real-life projects in the construction sector.

We asked investors, developers, contractors, engineers, architects, and designers from all over the world a series of questions. By downloading this data set, you will get a better understanding of:

The Marble Pier is a jointly-delivered project by Ramboll and Henning Larsen for AP Pension. The Marble Pier will be one of the largest timber buildings ever constructed in Denmark.

The eight-storey office building at Kristian August Gate 13 is an excellent example of a sustainable construction with its BREEAM-NOR-certification of ‘Very Good.’

In Uppsala, Vasakronan is building Sweden’s largest wooden office building, Magasin X, with a frame built entirely of wood. The building’s wooden frame will be visible to passers-by through its glass façade.

Operating 100% on renewable energy and with negative operational carbon emissions, Lidl’s distribution centre in Järvenpää excels in sustainable and smart solutions.

The 16,000 m2 Central Library Oodi embodies a new era of libraries in Finland. Besides functioning as a traditional library, the modern and vibrant space serves as a new cultural hub for the citizens of Helsinki.

The Makers District is set to become one of Abu Dhabi’s most iconic communities. The aim of the project is to create a vibrant residential community responding to the artistic maker movement while inspiring to a more sustainable future.